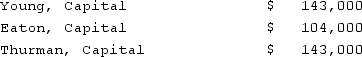

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Thurman's total share of net loss for the first year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Thurman's total share of net loss for the first year?

Definitions:

Means of Production

The resources—including tools, factories, and land—required to produce goods and services.

Social Classes

Divisions in society based on factors such as wealth, occupation, education, and power.

Source of Income

The origin or means through which an individual, family, or entity receives money or financial support.

Status Groups

Differ from one another in terms of the prestige or social honor they enjoy and in terms of their lifestyle.

Q8: What term is used for a bankruptcy

Q24: On May 1, 2021, Mosby Company received

Q33: Which of the following is not a

Q42: P, L, and O are partners with

Q43: The Town of Portsmouth has at the

Q45: How does a not-for-profit entity account for:

Q57: Peter, Roberts, and Dana have the following

Q73: Under what circumstances would the remeasurement of

Q74: A not-for-profit entity provides the following information

Q344: In economics, activities done for others, such