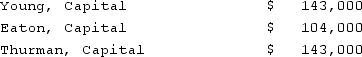

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Young's Capital account at the end of the first year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Young's Capital account at the end of the first year?

Definitions:

Long-Run Equilibrium

A state in which all factors of production and economic inputs can be fully adjusted, and all market forces are balanced.

Increase in Demand

A situation where the quantity of a good or service that consumers are willing and able to purchase at a particular price rises.

Marginal Revenue

The additional revenue that a firm gains when it sells one more unit of a product or service.

Average Total Cost

The total cost of production (fixed plus variable costs) divided by the number of units produced.

Q35: How do intra-activity and interactivity transactions differ

Q40: When preparing a consolidation worksheet for a

Q44: All of the following items are liabilities

Q52: What Federal agency has Congressional authority to

Q54: Which of the following is not a

Q56: The executor of the Estate of Kate

Q71: What are possible plans that management of

Q92: Certain balance sheet accounts of a foreign

Q173: In the market for factors of production,

Q181: Refer to Figure 1-6. Calculate the area