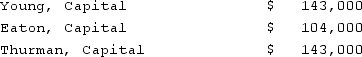

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Thurman's Capital account at the end of the first year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Thurman's Capital account at the end of the first year?

Definitions:

Point Estimate

Single value used to estimate an unknown population parameter.

Population Parameter

A numerical value that represents a characteristic of an entire population, such as its mean or standard deviation.

Standard Error

The standard deviation of the sampling distribution of a statistic, most commonly the mean; it is used to estimate the accuracy of a sample mean compared to the population mean.

Confidence Interval

A range of values, derived from sample statistics, that is believed to contain the true value of a population parameter with a certain level of confidence.

Q5: What occurs in the accounting records for

Q9: In settling an estate, what is the

Q12: What is a private placement of securities?

Q13: What information is required in proxy statements?(1)

Q14: Goodman, Pinkman, and White formed a partnership

Q15: What three criteria must be met before

Q22: IFRS for SMEs differ from full IFRS

Q28: Under the temporal method, inventory at net

Q47: What is the basis of accounting used

Q51: Which of the following statements is false