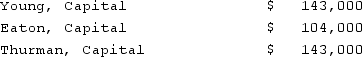

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Young's total share of net loss for the first year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Young's total share of net loss for the first year?

Definitions:

Maturity Bond

A bond at the end of its term, at which point the principal amount is due to be paid back to the bondholder.

Coupon Bond

A type of bond that pays the holder periodic interest payments based on the stated coupon rate and then returns the principal at maturity.

Market Yield

The annual income return on an investment, expressed as a percentage of the market price.

Face Value

The nominal value printed on a security or financial instrument, such as a bond or stock, at issue.

Q7: The Town of Portsmouth has at the

Q15: What is a primary focus of the

Q18: Nelson Co. ordered parts costing §120,000 from

Q33: How can a parent corporation determine the

Q35: Kennedy Company acquired all of the outstanding

Q36: Madison Township has received a donation of

Q52: What Federal agency has Congressional authority to

Q70: Payroll taxes payable would be included in

Q76: What is included in Part I of

Q83: Where is the translation adjustment reported in