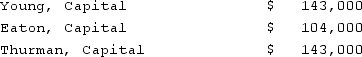

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Thurman's Capital account at the end of the first year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Thurman's Capital account at the end of the first year?

Definitions:

Ampulla

A widening or dilation in a tubular structure, such as the ampulla of Vater in the digestive system or the ampullae of the fallopian tubes.

Infundibulum

A funnel-shaped structure, often referring to the connection between the hypothalamus and the pituitary gland or the passageway in the female reproductive system leading to the fallopian tubes.

Testosterone

A primary male sex hormone responsible for the development of male secondary sexual characteristics.

Interstitial Cells

Specialized cells in the testes responsible for the production of testosterone.

Q22: The executor of the Estate of Kate

Q25: What events or circumstances might force the

Q27: Which account should be credited to record

Q27: A net liability balance sheet exposure exists

Q37: The SEC's role in the initial registration

Q44: Under modified accrual accounting, when are expenditures

Q70: The terms of a will currently undergoing

Q84: The provisions of a will currently undergoing

Q85: All of the following data points are

Q94: Gaw Produce Company purchased inventory from a