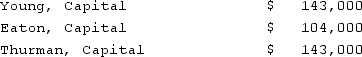

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Eaton's total share of net income for the second year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Eaton's total share of net income for the second year?

Definitions:

Personality Style

An individual's typical pattern of thinking, feeling, and acting in various situations.

Locus of Control

A psychological concept referring to the extent to which individuals believe they have power over events in their lives.

Value Orientations

The general principles or ideals that guide an individual's or a society's behavior and beliefs.

Industry

Pertains to the economic activity concerned with the processing of raw materials and manufacture of goods in factories, as well as the sector of the economy characterized by such activities.

Q10: The terms of a will currently undergoing

Q19: What is a safe cash payment?

Q24: The City of Wade has a fiscal

Q36: On June 14, 2021, Carbondale City agreed

Q37: The SEC's role in the initial registration

Q52: Not-for-profit entities are required to present information

Q57: Lapin Corp. owned the following assets when

Q58: Norr and Caylor established a partnership on

Q81: Why are the terms of the Articles

Q85: Which of the following is not subtracted