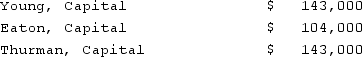

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Young's Capital account at the end of the second year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Young's Capital account at the end of the second year?

Definitions:

mRNA Codons

Triplets of nucleotides in messenger RNA that specify the addition of a specific amino acid or the termination of translation.

Cytoplasm

Semifluid substance enclosed by a cell’s plasma membrane.

Bacteria

Singular bacterium. The most diverse and well-known group of prokaryotes.

Archaea

Singular archaean. Group of single-celled organisms that lack a nucleus but are more closely related to eukaryotes than to bacteria.

Q16: Which one of the following financial statements

Q20: What is the five-step progression that a

Q24: What is a proxy? Briefly explain the

Q33: How can a parent corporation determine the

Q46: Which of the following is not a

Q51: Withdrawals from the partnership capital accounts are

Q52: Which method of translating a foreign subsidiary's

Q60: Assume the partnership of Howell, Madrid, and

Q64: The appropriate format of the December 31,

Q290: If the price of milk was $1.25