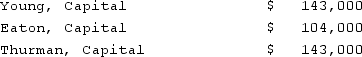

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Eaton's Capital account at the end of the second year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Eaton's Capital account at the end of the second year?

Definitions:

Opportunity Cost

The cost of forgoing the next best alternative when making a decision, representing the benefits that could have been received but were sacrificed in the pursuit of another option.

Debt-Equity Ratio

The quotient of total liabilities and shareholders' equity, representing a company's leverage financially.

Dividend Growth Model

A method for valuing a stock by assuming constant dividend growth and using future dividends to forecast stock price.

Q1: Goodman, Pinkman, and White formed a partnership

Q2: All of the following are influences on

Q13: The Amos, Billings, and Cleaver partnership had

Q21: On March 1, 2021, Mattie Company received

Q28: Revenue from property taxes should be recorded

Q46: Alpha, Inc., a U.S. company, had a

Q64: Which of the following is an example

Q84: Coyote Corp. (a U.S. company in Texas)

Q84: Which of the following is a fiduciary

Q88: The forward rate may be defined as<br>A)