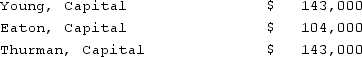

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Thurman's Capital account at the end of the second year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Thurman's Capital account at the end of the second year?

Definitions:

Canadian Nursing Practice

The standards and practices that govern the professional conduct and responsibilities of nurses in Canada.

Legal Principles

Foundational rules or concepts that guide the legal system and the administration of justice.

Accreditation

The formal recognition provided to an institution or program for meeting predefined standards.

Operative Procedure

Any medical operation carried out to diagnose or treat illness or injury, involving direct manipulation or surgery on the body.

Q7: The Town of Portsmouth has at the

Q8: The City of Ibiza maintains a collection

Q9: Which type of account would you assign

Q14: Which of the following is a financial

Q35: The executor of the Estate of Kate

Q35: Mount Inc. was a hardware store that

Q56: What are the two primary methods used

Q59: Hampton Company is trying to decide whether

Q67: Clark Co., a U.S. corporation, sold inventory

Q275: Two-dimensional graphs have a horizontal and a