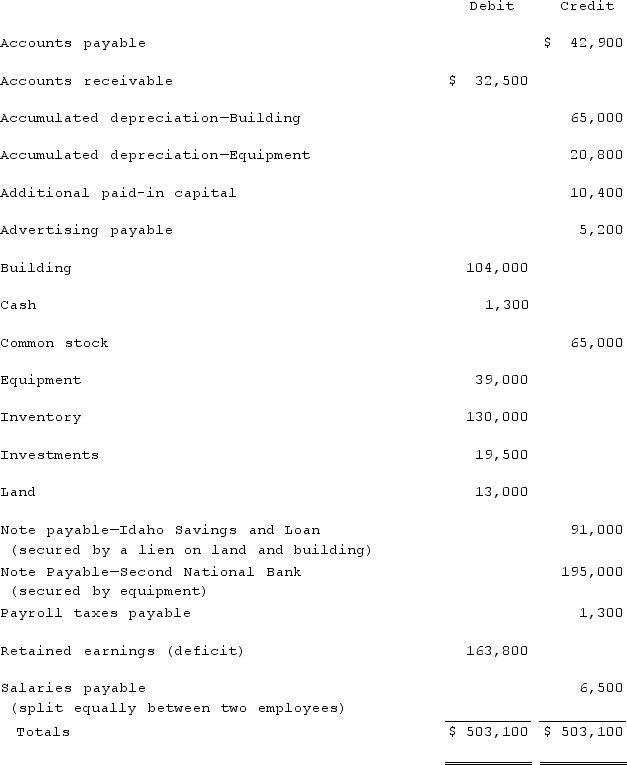

Mount Inc. was a hardware store that operated in Boise, Idaho. Management made some poor inventory acquisitions that loaded the store with unsalable merchandise. Due to the decline in revenues, the company became insolvent. Following is a trial balance as of March 15, 2021, the day the company filed for Chapter 7 liquidation.  Company officials believed that sixty percent of the accounts receivable could be collected if the company was liquidated. The building and land had a fair value of $97,500, while the equipment was worth $24,700. The investments represented shares of a publicly traded company that could be sold at the time for $27,300. The entire inventory could be sold for only $42,900. Administrative expenses necessary to carry out a liquidation were estimated to be $20,800.How much cash would have been paid to an unsecured non-priority creditor who was owed a total of $1,300 by Mount Inc.? (Round the payout percentage to a whole number.)

Company officials believed that sixty percent of the accounts receivable could be collected if the company was liquidated. The building and land had a fair value of $97,500, while the equipment was worth $24,700. The investments represented shares of a publicly traded company that could be sold at the time for $27,300. The entire inventory could be sold for only $42,900. Administrative expenses necessary to carry out a liquidation were estimated to be $20,800.How much cash would have been paid to an unsecured non-priority creditor who was owed a total of $1,300 by Mount Inc.? (Round the payout percentage to a whole number.)

Definitions:

Art Gallery

A place where artworks are displayed and sold to the public.

Strategic Buyer

A type of buyer in a business acquisition that seeks to purchase another company to achieve strategic goals, such as entering new markets or accessing new technologies.

Financial Buyer

A type of buyer in acquisitions primarily focused on the investment potential and financial returns of the purchase rather than strategic or operational synergies.

Mental Picture

An image or visualization created in the mind that represents ideas, visions, or potential outcomes; often used in planning and creative processes.

Q7: The partners of Donald, Chief & Berry

Q31: What criteria did the FASB establish for

Q31: What is shelf registration?

Q37: With respect to the donations received in

Q47: How should the fresh start reorganization value

Q48: Perez Company, a Mexican subsidiary of a

Q63: How should revenues be recognized in interim

Q75: Dilty Corp. owned a subsidiary in France.

Q83: Assume the partnership of Dean, Hardin, and

Q96: Natarajan, Inc. had the following operating segments,