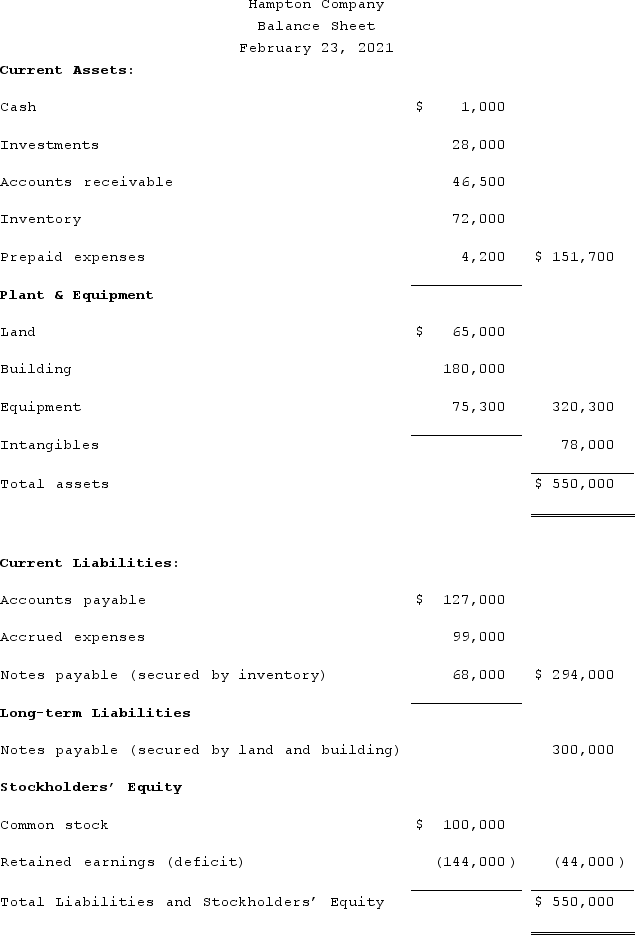

Hampton Company is trying to decide whether to seek liquidation or reorganization. Hampton has provided the following balance sheet:  Additional information is as follows:The investments are currently worth $13,000.It is estimated that $32,000 of the accounts receivable are collectible.The inventory can be sold for $74,000.The prepaid expenses and the intangible assets have no net realizable value.The land and building are currently valued at $250,000.The equipment can be sold for $60,000.Administrative expenses (not yet recorded) are estimated to be $12,500.Accrued expenses include $17,000 of salaries payable ($11,000 to one employee and $3,000 each to two other employees).Accrued expenses include $7,000 of unpaid payroll taxes.Prepare a schedule to show the amount of unsecured liabilities without priority.

Additional information is as follows:The investments are currently worth $13,000.It is estimated that $32,000 of the accounts receivable are collectible.The inventory can be sold for $74,000.The prepaid expenses and the intangible assets have no net realizable value.The land and building are currently valued at $250,000.The equipment can be sold for $60,000.Administrative expenses (not yet recorded) are estimated to be $12,500.Accrued expenses include $17,000 of salaries payable ($11,000 to one employee and $3,000 each to two other employees).Accrued expenses include $7,000 of unpaid payroll taxes.Prepare a schedule to show the amount of unsecured liabilities without priority.

Definitions:

Predatory Pricing

A competitive strategy where a firm sets very low prices with the intent to drive competitors out of the market or hinder their ability to compete.

Showrooming

The practice of examining merchandise in a traditional brick and mortar retail store without purchasing it, then shopping online to find a better deal on the same item.

Price Discrimination

A pricing strategy where identical or similar products or services are sold at different prices to different customers.

Price Fixing

An illegal agreement between parties to set prices at a certain level, preventing fair competition and manipulating the market.

Q19: What is meant by the term legally

Q26: A $6,000,000 bond is issued by Kensington

Q29: Which statement is false regarding the Statement

Q35: The executor of the Estate of Kate

Q40: Peter, Roberts, and Dana have the following

Q52: Potter Corp. (a U.S. company in Colorado)

Q53: A company is preparing financial statements using

Q57: Kennedy Company acquired all of the outstanding

Q59: A partnership began its first year of

Q62: Goodman, Pinkman, and White formed a partnership