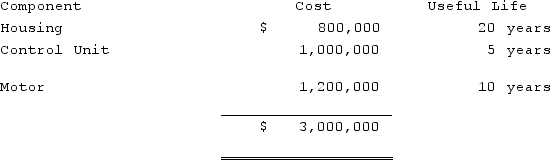

Teapot, Ltd. is a foreign company that uses IFRS for its financial reporting. Teapot is a wholly-owned subsidiary of Davis Housewares Corp. which is a U.S. company that prepares its consolidated financial statements in accordance with U.S. GAAP. Teapot purchased a piece of equipment for $3,000,000 on January 1, 2020. The equipment has an overall useful life of 20 years and no salvage value. The equipment is comprised of the following three significant components, shown with their associated cost and useful life.  As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.Prepare the journal entry for the 2020 depreciation expense for Teapot, Ltd. based on IFRS accounting principles.

As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.Prepare the journal entry for the 2020 depreciation expense for Teapot, Ltd. based on IFRS accounting principles.

Definitions:

Hand-Off Report

A communication exchange between healthcare providers detailing a patient's current status, care, and needs during transitions of care.

Acetaminophen

A medication used to reduce fever and relieve pain; also known as paracetamol.

I-SBAR-R

An acronym for Introduction, Situation, Background, Assessment, Recommendation, Read-back, used in healthcare to improve communication and patient safety.

Communication Technique

A method or strategy used to convey information effectively and clearly between individuals or groups, critical in healthcare for ensuring accurate and efficient patient care.

Q3: When a city received a county grant

Q7: Partnerships have alternative legal forms including all

Q11: As of January 1, 2021, the partnership

Q34: The partners of Donald, Chief & Berry

Q41: For what purpose is the SEC's Registration

Q60: The Marshall County legislature voted to set

Q67: Clark Co., a U.S. corporation, sold inventory

Q77: For what events or conditions should the

Q99: The benefits of filing a consolidated tax

Q117: Harrison Company, Inc. began operations on January