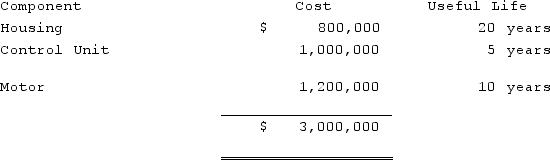

Teapot, Ltd. is a foreign company that uses IFRS for its financial reporting. Teapot is a wholly-owned subsidiary of Davis Housewares Corp. which is a U.S. company that prepares its consolidated financial statements in accordance with U.S. GAAP. Teapot purchased a piece of equipment for $3,000,000 on January 1, 2020. The equipment has an overall useful life of 20 years and no salvage value. The equipment is comprised of the following three significant components, shown with their associated cost and useful life.  As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.On December 31, 2020, Wave Corp. a foreign subsidiary of Pepper Corp., had a bank overdraft of $30,000 on one of its bank accounts. Bank overdrafts are an integral part of Wave's cash management policy.1) Prepare the journal entry to convert the foreign subsidiary from its IFRS financial statements to U.S.GAAP financial statements.2) Briefly explain why this journal entry is required.

As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.On December 31, 2020, Wave Corp. a foreign subsidiary of Pepper Corp., had a bank overdraft of $30,000 on one of its bank accounts. Bank overdrafts are an integral part of Wave's cash management policy.1) Prepare the journal entry to convert the foreign subsidiary from its IFRS financial statements to U.S.GAAP financial statements.2) Briefly explain why this journal entry is required.

Definitions:

Intrinsic Value

The perceived or calculated true value of an asset, based on fundamentals, without regard to market value.

Actual Stock Price

The current trading price of a company's shares on the stock market.

Required Return

This is the percentage yield that an investor expects to earn from an investment to make it worthwhile.

Common Share

A type of equity share that represents ownership in a company, granting the holder voting rights and a share in the company's profits through dividends.

Q28: Revenue from property taxes should be recorded

Q28: In the 2012 Financial Staff Report issued

Q45: On January 1, 2021, Harley Company bought

Q59: What term is used to describe a

Q66: Oakwood Co. filed a bankruptcy petition and

Q67: A partnership began its first year of

Q77: In a statement of financial affairs, assets

Q79: The following information has been taken from

Q81: Which of the following statements is true

Q105: How does a company measure income tax