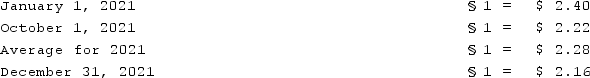

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2021 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2022. A building was then purchased for §170,000 on January 1, 2021. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2021. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:  Prepare an income statement for this subsidiary in stickles and then translate these amounts into U.S. dollars.

Prepare an income statement for this subsidiary in stickles and then translate these amounts into U.S. dollars.

Definitions:

Higher Management

A level of management that includes top executives who are responsible for making strategic decisions and overseeing the overall direction of an organization.

Layoff

The temporary or permanent termination of employment of an employee or group of employees for reasons not related to personal performance.

Verbal Communication

The use of spoken words to convey messages, thoughts, or information between individuals or groups.

Nonverbal Communication

The process of conveying meaning or information without using spoken words, through body language, facial expressions, gestures, and other cues.

Q21: What is meant by a "fully secured

Q26: Mount Inc. was a hardware store that

Q29: Ryan Company purchased 80% of Chase Company

Q41: The most recent FASB-IASB convergence projects include:<br>A)

Q48: Delta Corporation owns 90% of Sigma Company,

Q72: A $960,000 bond was issued on October

Q86: How can an import purchase result in

Q93: Under the temporal method, how would cost

Q107: Which items of information are required to

Q112: Cement Company, Inc. began the first quarter