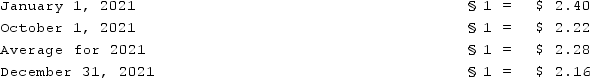

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2021 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2022. A building was then purchased for §170,000 on January 1, 2021. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2021. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:  Prepare a balance sheet for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Prepare a balance sheet for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Definitions:

Diagram

A simplified drawing showing the appearance, structure, or workings of something, often used for explanation purposes.

Economic Profit

The remaining profit once every cost, including those that are explicit and those that are implicit, is deducted from the total revenue.

Market Price

The current price at which a good or service can be bought or sold in a marketplace, determined by the forces of supply and demand.

Units

Basic quantities or measurements, such as liters, meters, or kilograms, used to specify magnitudes of physical quantities.

Q16: What are measurement differences in financial reporting

Q18: P, L, and O are partners with

Q28: Audited financial statements in an annual report

Q29: A local partnership has assets of cash

Q65: Poole Co. acquired 100% of Mullen Inc.

Q73: When indirect control is present, which of

Q75: Delta Corporation owns 90% of Sigma Company,

Q79: Under what circumstances does a partner's balance

Q88: The following information has been taken from

Q101: According to authoritative accounting literature, which of