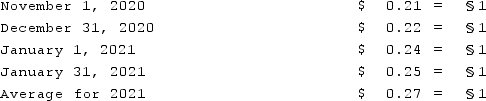

A subsidiary of Dunder Inc., a U.S. company, was located in a foreign country. The functional currency of this subsidiary was the Stickle (§) which is the local currency where the subsidiary is located. The subsidiary acquired inventory on credit on November 1, 2020, for §160,000 that was sold on January 17, 2021 for §207,000. The subsidiary paid for the inventory on January 31, 2021. Currency exchange rates between the dollar and the Stickle were as follows:  What amount would have been reported for this inventory in Dunder's consolidated balance sheet at December 31, 2020?

What amount would have been reported for this inventory in Dunder's consolidated balance sheet at December 31, 2020?

Definitions:

Saved Searches

A feature in various software and online platforms that allows users to save their search criteria for future use.

Boolean Operator

A logical statement used in search engines and programming to refine and specify the relationships between search terms.

Exact Phrase

A search query condition where the search engine looks for results containing all the specified words in the exact order without any changes.

SafeSearch Settings

A feature in search engines that acts as a filter to block potentially harmful or inappropriate content from search results.

Q7: Which of the following is a correct

Q9: Kennedy Company acquired all of the outstanding

Q21: Wayne, Inc. has four operating segments with

Q22: Which statement is false regarding the registration

Q24: Florrick Co. owns 85% of Bishop Inc.

Q38: According to U.S. GAAP, when the local

Q48: A partnership has assets of cash of

Q53: Under the temporal method, depreciation expense would

Q61: Where should a company undergoing reorganization report

Q73: What is the purpose of government-wide financial