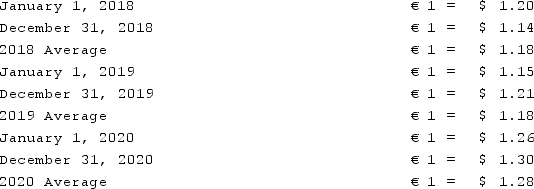

A subsidiary of Reynolds Inc., a U.S. company, was located in a foreign country. The local currency of this subsidiary was the Euro (€) while the functional currency of this subsidiary was the U.S. dollar. The subsidiary acquired Equipment A on January 1, 2018, for €250,000. Depreciation expense associated with Equipment A was €25,000 per year. On January 1, 2020, the subsidiary acquired Equipment B for €150,000 and Equipment B had associated depreciation expense of €10,000. The subsidiary owned no other depreciable assets. Currency exchange rates between the U.S. dollar and the Euro were as follows:  What amount would have been reported for total equipment owned by the subsidiary in Reynolds's consolidated balance sheet at December 31, 2020?

What amount would have been reported for total equipment owned by the subsidiary in Reynolds's consolidated balance sheet at December 31, 2020?

Definitions:

Incorporation Jurisdictions

The specific geographical locations whose legal frameworks govern the formation, operation, and dissolution of corporations.

Abolished

The act of formally putting an end to a system, practice, or institution.

Bondholders

Individuals or entities that hold debt securities issued by corporations or governments, entitling them to receive the bond's principal and interest payments.

Participants

Individuals or entities that take part in an activity, process, or event, often contributing to its outcome.

Q26: Under the temporal method, retained earnings would

Q28: Alpha Corporation owns 100% of Beta Company,

Q31: What is shelf registration?

Q35: Mount Inc. was a hardware store that

Q42: How do outstanding subsidiary stock warrants affect

Q76: Webb Company purchased 90% of Jones Company

Q76: Under the current rate method, depreciation expense

Q77: To account for a forward contract cash

Q93: On June 1, Cagle Co. received a

Q98: Which one of the following items must