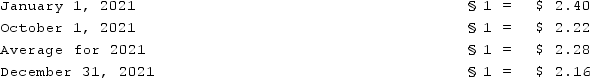

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2021 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2022. A building was then purchased for §170,000 on January 1, 2021. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2021. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:  Prepare a statement of retained earnings for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Prepare a statement of retained earnings for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Definitions:

Retaining Information

The process of keeping or maintaining knowledge in the memory for a period of time.

Releasing Information

The process of providing or disseminating information to parties who are authorized to receive it.

Knowledge

The information, understanding, and skills that individuals acquire through experience, education, and training.

Personal Qualifications

The abilities, experience, and educational background that make an individual suitable for a particular job or task.

Q15: Panton, Inc. acquired 18,000 shares of Glotfelty

Q19: Which of the following is not an

Q33: What is the role of the trustee

Q37: On January 1, 2021, Rhodes Co. owned

Q44: Where do dividends paid to the noncontrolling

Q51: A parent company owns a controlling interest

Q65: Poole Co. acquired 100% of Mullen Inc.

Q99: The benefits of filing a consolidated tax

Q102: Which of the following is not a

Q108: Woolsey Corporation, a U.S. company, expects to