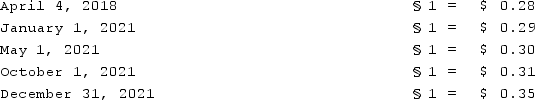

Boerkian Co. started 2021 with two assets: Cash of §26,000 (Stickles) and Land that originally cost §72,000 when acquired on April 4, 2018. On May 1, 2021, the company rendered services to a customer for §36,000, an amount immediately paid in cash. On October 1, 2021, the company incurred an operating expense of §22,000 that was immediately paid. No other transactions occurred during the year so an average exchange rate is not necessary. Currency exchange rates were as follows:  Required:Assume that Boerkian was a foreign subsidiary of a U.S. multinational company and the local currency of the subsidiary (stickle) is the functional currency. On the December 31, 2021 balance sheet, what was the translated value of the Land account?

Required:Assume that Boerkian was a foreign subsidiary of a U.S. multinational company and the local currency of the subsidiary (stickle) is the functional currency. On the December 31, 2021 balance sheet, what was the translated value of the Land account?

Definitions:

Current Rate

The present value of foreign currencies in terms of domestic currency, used in converting foreign transactions to the domestic currency denomination in accounting.

Translation

In accounting, refers to the process of converting financial statements from one currency into another, often for consolidation purposes.

Foreign Currency Transactions

Foreign currency transactions involve the exchange of one country's currency for another, affecting companies that engage in international trade or investment.

Monetary Assets

Assets that hold a fixed monetary value, including cash and assets that can be easily converted into cash.

Q19: What are some ways by which the

Q23: A local partnership was considering the possibility

Q33: What is a letter of comments?

Q36: What are the four types of authoritative

Q43: Donald, Anne, and Todd have the following

Q58: Potter Corp. (a U.S. company in Colorado)

Q72: What factors create a foreign exchange gain?

Q72: What is an order for relief?

Q85: Which of the following statements is false

Q106: Faru Co. identified five industry segments: (1)