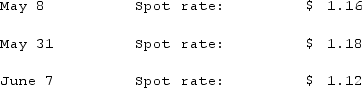

Clark Stone purchases raw material from its foreign supplier, Rinne Clay, on May 8. Payment of 1,500,000 foreign currency units (FC) is due in 30 days. May 31 is Clark's fiscal year-end. The pertinent exchange rates were as follows:  How much US $ will it cost Clark to finally pay the payable on June 7?

How much US $ will it cost Clark to finally pay the payable on June 7?

Definitions:

Q7: For a foreign subsidiary that uses the

Q15: The Nigel Co. had four separate operating

Q33: Goodman, Pinkman, and White formed a partnership

Q37: Which of the following is the organization

Q45: During a partnership liquidation, how are gains

Q48: Delta Corporation owns 90% of Sigma Company,

Q65: The balance sheets of Butler, Inc. and

Q72: What factors create a foreign exchange gain?

Q76: Webb Company purchased 90% of Jones Company

Q90: How is accounting for a partnership different