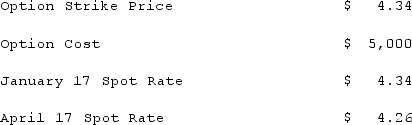

Atherton, Inc., a U.S. company, expects to order goods from a foreign supplier at a price of 100,000 lira, with delivery and payment to be made on April 17. On January 17, Atherton purchased a three-month call option on 100,000 lira and designated this option as a cash flow hedge of a forecasted foreign currency transaction. The following exchange rates apply:  What amount will Atherton include as an option expense in net income for the period January 17 to April 17?

What amount will Atherton include as an option expense in net income for the period January 17 to April 17?

Definitions:

Profit-Maximizing

The process by which a company determines the price and output level that returns the highest profit.

Loss-Minimizing

A strategy or position where a firm aims to reduce its losses to the lowest possible level under adverse conditions, often by adjusting production.

Zero Economic Profits

Zero economic profits occur in a competitive equilibrium when firms earn just enough revenue to cover their total costs, including the opportunity costs.

Short Run

A period of time during which at least one of a firm's inputs is fixed, limiting its ability to increase production.

Q12: Chapman Co. acquired all of Klein Co.

Q15: Which of the following is not a

Q17: Walsh Company sells inventory to its subsidiary,

Q24: Macklin Co. owned 70% of Holland Corp.

Q28: Wilson owned equipment with an estimated life

Q48: What are free assets?<br>A) Assets for which

Q50: On October 31, 2020, Darling Company negotiated

Q57: ASU, Inc., a U.S. company, was acquired

Q64: Which of the following securities offerings is

Q70: Which of the following must be disclosed