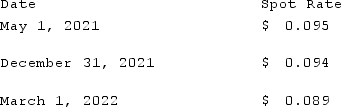

On May 1, 2021, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2022. On May 1, 2021, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2022 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2021. The following spot exchange rates apply:  Mosby's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the impact on Mosby's 2021 net income as a result of this fair value hedge of a firm commitment?

Mosby's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the impact on Mosby's 2021 net income as a result of this fair value hedge of a firm commitment?

Definitions:

Collaborative Partnership Model

A cooperative approach to healthcare that involves shared decision-making among patients, families, and providers.

Mutual Respect

A reciprocal understanding and esteem between individuals or groups, recognizing and valuing each other's rights and feelings.

Conflict Management

The practice of identifying and handling conflicts in a sensible, fair, and efficient manner.

Shut-Ins

Individuals who are confined indoors, typically due to physical, mental, or emotional health issues, limiting their ability to engage with the outside world.

Q18: On January 1, 2021, Harley Company bought

Q23: What happens when a U.S. company purchases

Q39: Jerry, a partner in the JSK partnership,

Q52: Gardner Corp. owns 80% of the voting

Q55: Bazley Co. had severe financial difficulties and

Q60: Name five securities offerings exempt from registration

Q68: Bazley Co. had severe financial difficulties and

Q83: Stark Company, a 90% owned subsidiary of

Q97: Strickland Company sells inventory to its parent,

Q116: On January 1, 2021, Pride, Inc. acquired