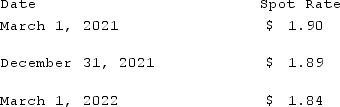

On March 1, 2021, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2022. On March 1, 2021, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2022 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2021. The following spot exchange rates apply:  Mattie's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the net impact on Mattie's 2021 income as a result of this fair value hedge of a firm commitment?

Mattie's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the net impact on Mattie's 2021 income as a result of this fair value hedge of a firm commitment?

Definitions:

Dissolve

The process of formally closing or ending a legal entity, such as a corporation or partnership, and distributing its assets.

Partnership

A legal form of business operation between two or more individuals who share management and profits or losses.

Operating Agreement

An operating agreement is a legal document outlining the governance and business operations of an LLC (Limited Liability Company).

Limited Liability Company

An organizational framework that blends the individual tax reporting features of partnerships or sole proprietorships with the reduced personal legal responsibility found in corporations.

Q15: On January 1, 2021, Lamb and Mona

Q36: Jackson Corp. (a U.S.-based company) sold parts

Q51: Which of the following is not a

Q53: White Company owns 60% of Cody Company.

Q53: Norr and Caylor established a partnership on

Q57: ASU, Inc., a U.S. company, was acquired

Q62: Cement Company, Inc. began the first quarter

Q66: Which statement is true regarding a foreign

Q97: T Corp. owns several subsidiaries that are

Q100: Certain balance sheet accounts of a foreign