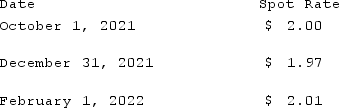

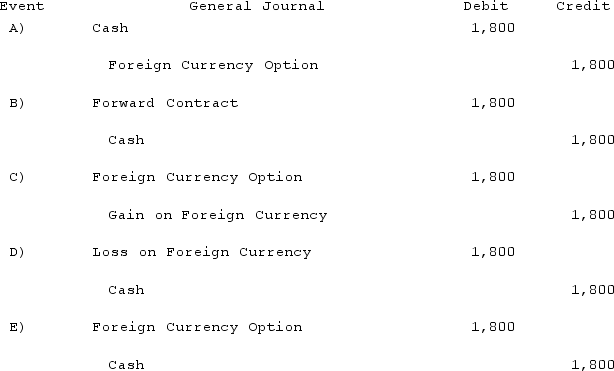

On October 1, 2021, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2022, at a price of 100,000 British pounds. On October 1, 2021, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2021, the option has a fair value of $1,600. The following spot exchange rates apply:  What journal entry should Eagle prepare on October 1, 2021?

What journal entry should Eagle prepare on October 1, 2021?

Definitions:

Functionalist Perspective

A sociological theory that considers society to be a complicated system in which various components function collaboratively to foster unity and steadiness.

Deviance

Behaviors or actions that violate social norms or expectations, which can range from minor to serious.

Moral Boundaries

The limits that define acceptable behavior and beliefs according to societal standards and ethics.

Typology Of Deviance

A classification scheme that categorizes different forms of deviant behavior based on their perceived or actual social harm.

Q8: What are recognition differences in financial reporting

Q24: What is a proxy? Briefly explain the

Q24: All of the following are simplified principles

Q43: Stark Company, a 90% owned subsidiary of

Q47: What events cause the dissolution of a

Q54: Dayton, Inc. owns 80% of Haber Corp.

Q64: Schilling, Inc. has three operating segments with

Q77: For what events or conditions should the

Q106: Dog Corporation acquires all of Cat, Inc.

Q124: Florrick Co. owns 85% of Bishop Inc.