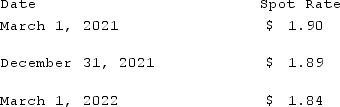

On March 1, 2021, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2022. On March 1, 2021, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2022 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2021. The following spot exchange rates apply:  Mattie's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the net impact on Mattie's 2021 income as a result of this fair value hedge of a firm commitment?

Mattie's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the net impact on Mattie's 2021 income as a result of this fair value hedge of a firm commitment?

Definitions:

Cramér's V

An indicator of the relationship strength between two categorical variables, ranging from 0 to 1.

Cramér's V

A measure of association between two nominal variables, giving a value between 0 and 1, where 0 means no association and 1 indicates perfect association.

Expected Frequency

The theoretical frequency of an event occurring in a set of trials, calculated based on probability theory.

Police Job

Employment or duties performed by individuals working in law enforcement, responsible for maintaining public order, enforcing laws, and preventing, detecting, and investigating crimes.

Q2: Lucky Co. had cash of $65,000, inventory

Q2: The partnership of Clapton, Seidel, and Thomas

Q23: Anderson Company, a 90% owned subsidiary of

Q25: Strickland Company sells inventory to its parent,

Q46: Palmer Co. had the following amounts for

Q52: Anderson, Inc. has owned 70% of its

Q58: Which of the following statements is true

Q67: Thomas Inc. had the following stockholders' equity

Q67: Which of the following statements is true

Q85: Which of the following statements is false