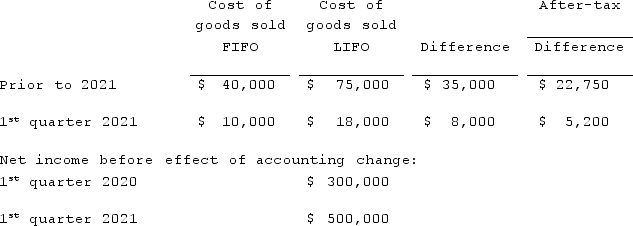

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2021. Baker has an effective income tax rate of 35% and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2021 and that $400,000 net income is earned during the second quarter, how much is reported as net income for the second quarter of 2021?

Assuming Baker makes the change in the first quarter of 2021 and that $400,000 net income is earned during the second quarter, how much is reported as net income for the second quarter of 2021?

Definitions:

Q2: The following information has been taken from

Q3: On December 1, 2021, King Co. sold

Q40: Pell Company acquires 80% of Demers Company

Q43: To what does the term Chapter 7

Q47: Regulation S-X specifies:<br>A) Requirements for the nonfinancial

Q52: Gardner Corp. owns 80% of the voting

Q52: Flax Co. acquired 80% percent of the

Q57: When must Form 8-K be filed with

Q57: During 2021, Parent Corporation purchased at carrying

Q119: Knight Co. owned 80% of the common