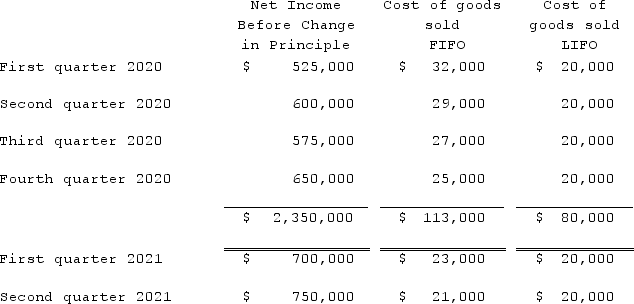

Harrison Company, Inc. began operations on January 1, 2020, and applied the LIFO method for inventory valuation. On June 10, 2021, Harrison adopted the FIFO method of accounting for inventory. Additional information is as follows:  The LIFO method was applied during the first quarter of 2021 and the FIFO method was applied during the second quarter of 2021 in computing income, above. Harrison's effective income tax rate is 40%. Harrison has 500,000 shares of common stock outstanding at all times.Prepare a schedule showing the calculation of net income and earnings per share to be reported by Harrison for the three-month period and the six-month period ended June 30, 2020 and 2021.

The LIFO method was applied during the first quarter of 2021 and the FIFO method was applied during the second quarter of 2021 in computing income, above. Harrison's effective income tax rate is 40%. Harrison has 500,000 shares of common stock outstanding at all times.Prepare a schedule showing the calculation of net income and earnings per share to be reported by Harrison for the three-month period and the six-month period ended June 30, 2020 and 2021.

Definitions:

Management Technique

Methods or strategies used by business leaders to improve efficiency, productivity, and outcomes in an organization.

Optimization

The process of making something as effective, perfect, or functional as possible, often by using mathematical models to find the best solution among alternatives.

New Features

Refers to the additions or enhancements made to a product, service, or software application to improve functionality or user experience.

Buying And Selling

The basic components of trade, involving the exchange of goods or services for payment or barter.

Q26: What approach is used, according to U.S.

Q29: On January 1, 2020, Jones Company bought

Q43: Wolff corporation owns 70% of the outstanding

Q47: On October 1, 2021, Eagle Company forecasts

Q52: What Federal agency has Congressional authority to

Q69: When Valley Co. acquired 80% of the

Q76: Prescott Inc. owned 80% of the voting

Q84: During 2020, Odyssey Co. sold inventory to

Q106: On January 1, 2021, Daniel Corp. acquired

Q122: Strong Company has had poor operating results