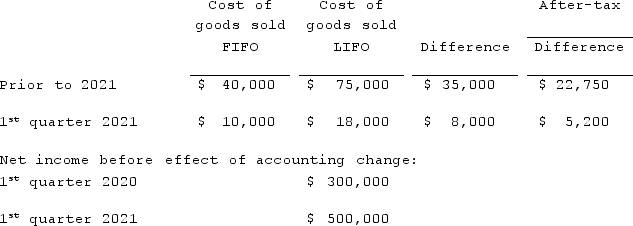

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2021. Baker has an effective income tax rate of 35% and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2020, how much is reported as net income for the first quarter of 2020?

Assuming Baker makes the change in the first quarter of 2020, how much is reported as net income for the first quarter of 2020?

Definitions:

Familiarity Breeds Contempt

A phrase that implies excessive familiarity with someone or something can lead to a loss of respect for them or it.

Companionate Love

The deep affectionate attachment we feel for those with whom our lives are intertwined.

Passionate Feelings

Passionate feelings involve intense emotions and a strong attraction towards another person, often characterized by excitement and desire.

Self-Disclosure

The act of sharing personal, private, or sensitive information about oneself with others, which can foster intimacy and trust in relationships.

Q11: According to U.S. GAAP, what general information

Q44: Teapot, Ltd. is a foreign company that

Q45: A foreign subsidiary of a U.S.-based company

Q51: What does the IASB's Conceptual Framework for

Q58: Which of the following statements is true

Q66: Esposito is an Italian subsidiary of a

Q84: Gardner Corp. owns 80% of the voting

Q97: T Corp. owns several subsidiaries that are

Q97: On January 1, 2021, Harrison Corporation spent

Q106: Dog Corporation acquires all of Cat, Inc.