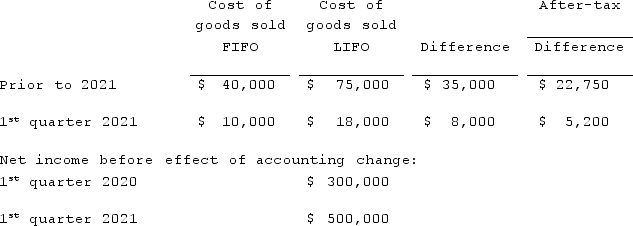

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2021. Baker has an effective income tax rate of 35% and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2021 and that $400,000 net income is earned during the second quarter, how much is reported as net income for the second quarter of 2021?

Assuming Baker makes the change in the first quarter of 2021 and that $400,000 net income is earned during the second quarter, how much is reported as net income for the second quarter of 2021?

Definitions:

Advertisement

A public notice especially in print, broadcast, or online, promoting the sale of goods or services.

Big Screen Television

A large television set, typically measuring over 55 inches diagonally, offering enhanced viewing experience for movies, sports, and other entertainment.

Intermodal Transportation

The use of multiple modes of transportation, such as trucks, ships, and trains, to move goods from origin to destination efficiently.

State Lines

Geographic boundaries that define the jurisdictional limits of a state within a country, affecting laws and regulations.

Q16: On January 1, 2021, Rhodes Co. owned

Q23: Pell Company acquires 80% of Demers Company

Q38: A statement of financial affairs created for

Q44: Teapot, Ltd. is a foreign company that

Q73: Parent Corporation recently acquired some of its

Q76: On October 1, 2021, Eagle Company forecasts

Q93: On January 1, 2021, Harrison Corporation spent

Q99: A subsidiary issues new shares of common

Q102: Ryan Company purchased 80% of Chase Company

Q106: Dog Corporation acquires all of Cat, Inc.