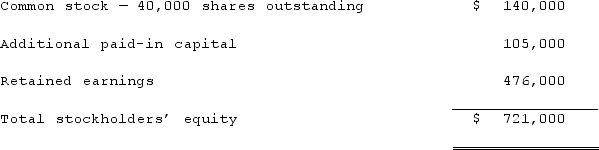

Popper Co. acquired 80% of the common stock of Cocker Co. on January 1, 2019, when Cocker had the following stockholders' equity accounts.  To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2022.Popper did not pay any premium when it acquired its original interest in Cocker. On January 1, 2022, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.On January 1, 2022, Cocker reacquired 8,000 of the outstanding shares of its own common stock for $34 per share. None of these shares belonged to Popper. How would this transaction have affected the additional paid-in capital of the parent company?

To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2022.Popper did not pay any premium when it acquired its original interest in Cocker. On January 1, 2022, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.On January 1, 2022, Cocker reacquired 8,000 of the outstanding shares of its own common stock for $34 per share. None of these shares belonged to Popper. How would this transaction have affected the additional paid-in capital of the parent company?

Definitions:

Job Performance

An employee's effectiveness in fulfilling job responsibilities and duties as outlined in their job description.

Research Hypothesis

An assertive statement predicting a particular relationship between two or more variables in a population being studied.

Vaccinations

Medical procedures that involve administering a vaccine to stimulate an individual's immune system to develop resistance to a specific infectious disease.

Autism

A developmental disorder characterized by difficulties in social interaction and communication, and by restricted or repetitive patterns of thought and behavior.

Q12: A U.S. company buys merchandise from a

Q21: Wayne, Inc. has four operating segments with

Q36: Hoyt Corporation agreed to the following terms

Q36: Which of the following is reported for

Q56: Pell Company acquires 80% of Demers Company

Q60: What is meant by the spot rate?

Q65: On January 1, 2019, Glenville Co. acquired

Q83: What is the partial equity method? How

Q112: The accounting problems encountered in consolidated intra-entity

Q114: On January 1, 2021, Harley Company bought