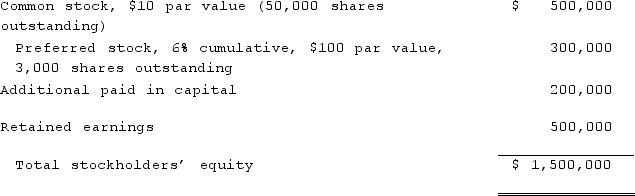

On January 1, 2021, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. There was no premium in the value of consideration transferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  With respect to Nichols' investment in Smith, determine the amount to be recorded and identify which account should be adjusted to reflect such amount.

With respect to Nichols' investment in Smith, determine the amount to be recorded and identify which account should be adjusted to reflect such amount.

Definitions:

Roommate's Presence

The state or condition of living with another individual in the same living space, contributing to shared environmental influences.

Video Games

Electronic games involving interaction with a user interface to generate visual feedback on a two- or three-dimensional video display device.

Conditioned Taste Aversion

The learned aversion to a food or drink after it has been associated with illness or discomfort, demonstrating classical conditioning.

Taste-Nausea Associations

A form of classical conditioning where an individual learns to associate a specific taste with subsequent nausea, often resulting in aversion to that taste.

Q9: Kennedy Company acquired all of the outstanding

Q11: Larson Company, a U.S. company, has an

Q47: A foreign subsidiary of a U.S. corporation

Q48: On December 1, 2021, Keenan Company, a

Q54: Under the temporal method, common stock would

Q69: If a subsidiary is operating in a

Q72: For companies that provide quarterly reports, how

Q73: On January 1, 2021, Pride, Inc. acquired

Q115: Harrison, Inc. acquires 100% of the voting

Q121: Several years ago, Polar Inc. acquired an