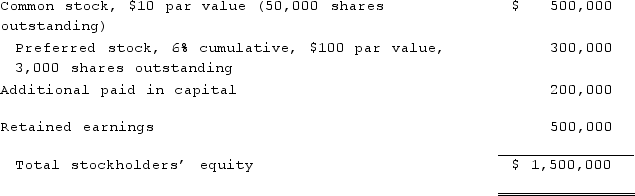

On January 1, 2021, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. There was no premium in the value of consideration transferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  Compute the noncontrolling interest in Smith at date of acquisition.

Compute the noncontrolling interest in Smith at date of acquisition.

Definitions:

Psychodynamic Therapies

A group of therapies that focus on uncovering and understanding unconscious motives and conflicts as a path to symptom resolution.

Systematic Desensitization

A behavior therapy that treats anxiety by teaching the client to associate deep relaxation with increasingly intense anxiety-producing situations.

Feared Situation

A scenario or setting that induces a heightened state of fear or anxiety in an individual.

Beck's Cognitive Therapy

A form of psychotherapy developed by Aaron T. Beck that identifies and helps change negative thought patterns and behaviors.

Q18: Which of the following statements is false

Q23: What happens when a U.S. company purchases

Q24: On May 1, 2021, Mosby Company received

Q39: One company acquires another company in a

Q50: What two disclosure guidelines for operating segment

Q60: How does the parent's choice of investment

Q74: Potter Corp. (a U.S. company in Colorado)

Q99: A subsidiary issues new shares of common

Q113: Crown Company had common stock of $360,000

Q122: On January 1, 2019, Jannison Inc. acquired