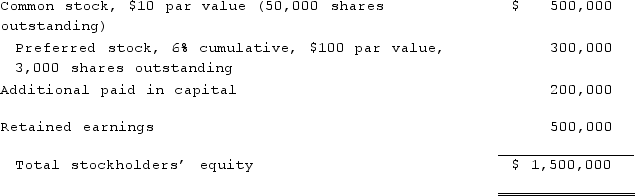

On January 1, 2021, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. There was no premium in the value of consideration transferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  If Smith's net income is $100,000 in the year following the acquisition,

If Smith's net income is $100,000 in the year following the acquisition,

Definitions:

V5 Neuron

A type of neuron that is primarily responsible for processing motion in the visual cortex of the brain.

Directions of Motion

The path along which something moves, proceeds, or is directed.

Corpus Callosum

Band of white matter containing about 200 million nerve fibers that connects the two cerebral hemispheres to provide a route for direct communication between them.

Prefrontal Association Cortex

A region of the frontal lobes involved in planning complex cognitive behaviors, personality expression, decision making, and moderating social behavior.

Q9: Hardford Corp. held 80% of Inglestone Inc.,

Q21: Wayne, Inc. has four operating segments with

Q24: Pell Company acquires 80% of Demers Company

Q24: Which of the following is not true

Q28: Why is it important to know if

Q32: Bassett Inc. acquired all of the outstanding

Q43: Wolff corporation owns 70% of the outstanding

Q51: According to GAAP regarding amortization of goodwill,

Q59: For recognized intangible assets that are considered

Q98: Black Co. acquired 100% of Blue, Inc.