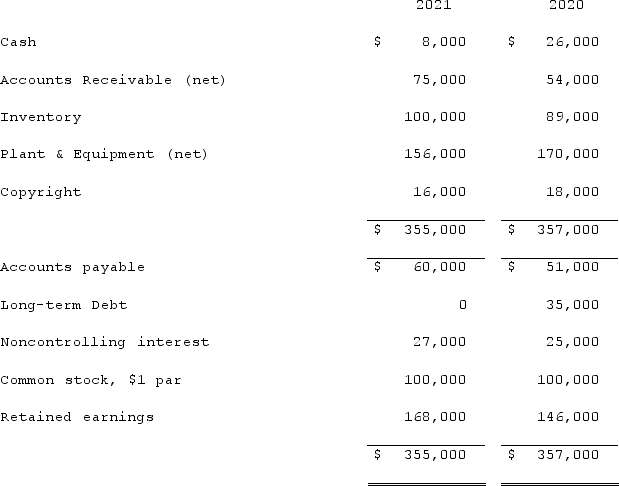

Anderson, Inc. has owned 70% of its subsidiary, Arthur Corp., for several years. The consolidated balance sheets of Anderson, Inc. and Arthur Corp. are presented below:  Additional information for 2021:The combination occurred using the equity method. Consolidated net income was $50,000. The noncontrolling interest share of consolidated net income of Arthur was $3,200.Arthur paid $4,000 in dividends.There were no purchases or disposals of plant & equipment or copyright this year.Net cash flow from operating activities was:

Additional information for 2021:The combination occurred using the equity method. Consolidated net income was $50,000. The noncontrolling interest share of consolidated net income of Arthur was $3,200.Arthur paid $4,000 in dividends.There were no purchases or disposals of plant & equipment or copyright this year.Net cash flow from operating activities was:

Definitions:

Holder in Due Course

A party who has acquired a negotiable instrument in good faith, for value, and without notice of any defects, and thus has certain legal protections.

Protections

Measures or provisions put in place to guard against harm, damage, or legal infringement, particularly in legal, economic, and technological contexts.

Negotiable Instrument

A textual document that pledges the payment of an exact monetary amount, to be made either when asked or at a predetermined time, and it specifies who will make the payment.

Sum Certain

A legal term referring to a specified or fixed amount of money.

Q17: In a step acquisition, which of the

Q34: Dean Hardware, Inc. is comprised of five

Q42: Dodd Co. acquired 75% of the common

Q53: Which of the following operating segment disclosures

Q56: Certain balance sheet accounts of a foreign

Q65: Which one of the following varies between

Q80: What is the appropriate treatment in an

Q84: What is meant by the term: disaggregated

Q97: Strickland Company sells inventory to its parent,

Q99: Potter Corp. (a U.S. company in Colorado)