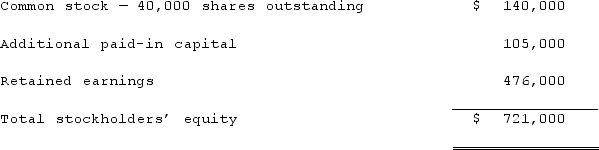

Popper Co. acquired 80% of the common stock of Cocker Co. on January 1, 2019, when Cocker had the following stockholders' equity accounts.  To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2022.Popper did not pay any premium when it acquired its original interest in Cocker. On January 1, 2022, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.On January 1, 2022, Cocker reacquired 8,000 of the outstanding shares of its own common stock for $34 per share. None of these shares belonged to Popper. How would this transaction have affected the additional paid-in capital of the parent company?

To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2022.Popper did not pay any premium when it acquired its original interest in Cocker. On January 1, 2022, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.On January 1, 2022, Cocker reacquired 8,000 of the outstanding shares of its own common stock for $34 per share. None of these shares belonged to Popper. How would this transaction have affected the additional paid-in capital of the parent company?

Definitions:

Incremental Cash Flow

The additional cash flow a project generates compared to a baseline or the current level.

Cost Of Goods Sold

Financial expenditures directly linked to the production of goods sold by a business, involving materials and labor.

Pro Forma Statements

Financial statements prepared to predict the financial position of a company under certain hypothetical scenarios or planning for future operations.

Total Cash Flows

The sum of all cash receipts and disbursements within a given period, including operating, investing, and financing activities.

Q17: Coyote Corp. (a U.S. company in Texas)

Q20: The FASB-IASB convergence project on leases resulted

Q21: How is goodwill amortized?<br>A) It is not

Q49: A subsidiary of Reynolds Inc., a U.S.

Q52: Elektronix, Inc. has three operating segments with

Q54: On January 1, 2020, Hemingway Co. acquired

Q73: Parent Corporation recently acquired some of its

Q86: Pell Company acquires 80% of Demers Company

Q88: The forward rate may be defined as<br>A)

Q106: On January 1, 2021, Daniel Corp. acquired