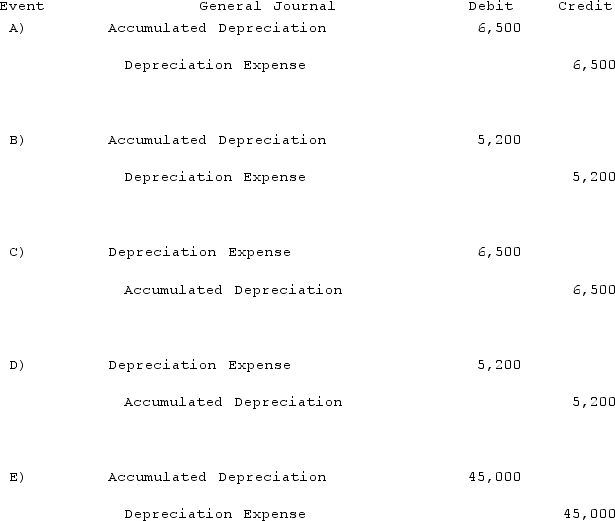

Palmer Corp. owned 80% of the outstanding common stock of Creed Inc. On January 1, 2019, Palmer acquired a building with a ten-year life for $450,000. No salvage value was anticipated and the building was to be depreciated on the straight-line basis. On January 1, 2021, Palmer sold this building to Creed for $412,000. At that time, the building had a remaining life of eight years but still no expected salvage value. For consolidation purposes, what is the Excess Depreciation (ED entry) for this building for 2021?

Definitions:

Lucky Charms

A brand of breakfast cereal produced by General Mills, characterized by its marshmallow shapes; colloquially, it can also refer to objects or symbols considered to bring good luck.

Skinner

B.F. Skinner, an American psychologist known for his work in behaviorism and for developing the theory of operant conditioning.

Pigeons

Birds that are often found in urban areas, known for their ability to find their way home over long distances, used in research for studying navigation and behavior.

Critical Thinking

Analytical thinking aimed at assessing the validity of information to make logical conclusions.

Q1: Brooks Co. acquired 90% of Hill Inc.

Q6: Renz Co. acquired 80% of the voting

Q11: Pell Company acquires 80% of Demers Company

Q20: On January 1, 2021, Parent Corporation acquired

Q63: How should revenues be recognized in interim

Q64: Parker Corp., a U.S. company, had the

Q66: When an investor appropriately applies the equity

Q99: An intra-entity transfer of a depreciable asset

Q109: Kaye Company acquired 100% of Fiore Company

Q113: Will Co. owned 80% of the voting