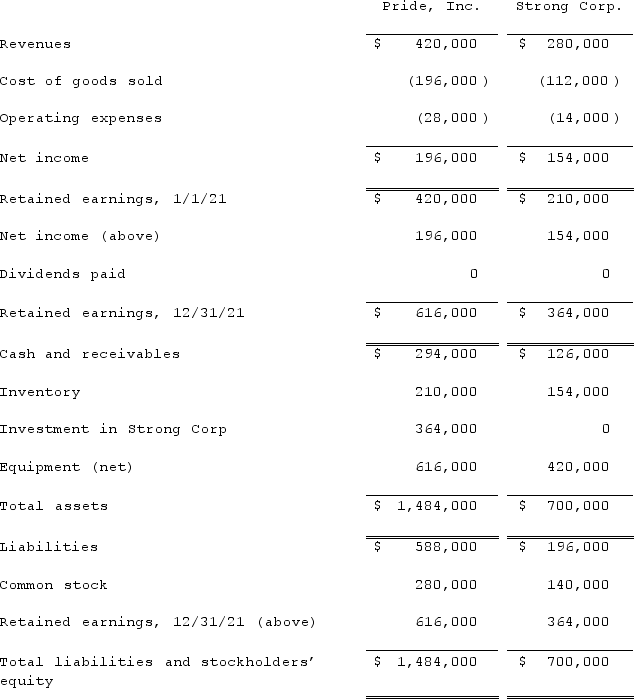

On January 1, 2021, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill, which has not been impaired.As of December 31, 2021, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the total of consolidated operating expenses at December 31, 2021?

During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the total of consolidated operating expenses at December 31, 2021?

Definitions:

Shortage/Surplus

Shortage occurs when demand exceeds supply, while surplus occurs when supply exceeds demand.

Quantity Demanded

The total amount of a good or service that consumers are willing and able to purchase at a given price level in a market.

Quantity Supplied

The quantity of a product or service suppliers are prepared to offer for sale at a specific price.

Price Ceiling

A government-imposed limit on how high a price can be charged on a product, aiming to keep essential goods affordable.

Q16: Wilkins Inc. acquired 100% of the voting

Q36: In a situation where the investor exercises

Q37: The financial statement amounts for the Atwood

Q41: In a tax-free business combination,<br>A) The income

Q66: Elektronix, Inc. has three operating segments with

Q72: On January 1, 2021, Musical Corp. sold

Q84: A variable interest entity can take all

Q101: Dunne Inc. bought 65% of the outstanding

Q103: On January 1, 2021, Nichols Company acquired

Q120: McCoy has the following account balances as