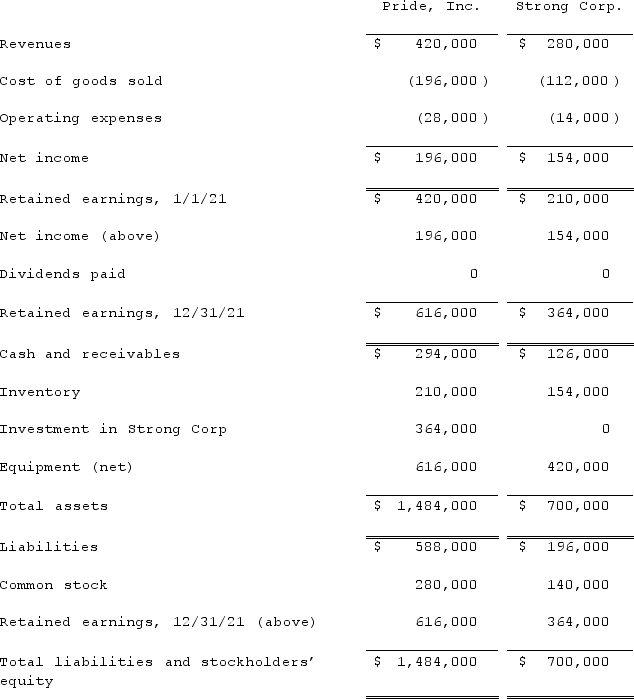

On January 1, 2021, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill, which has not been impaired.As of December 31, 2021, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the total of consolidated cost of goods sold at December 31, 2021?

During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the total of consolidated cost of goods sold at December 31, 2021?

Definitions:

Pleasant Activities

Engagements or tasks that bring joy, satisfaction, or pleasure to an individual.

Redemptive Narrative

A story or account that focuses on the theme of redemption; overcoming obstacles or hardships to achieve a positive transformation.

AA Participants

Individuals involved in Alcoholics Anonymous, a fellowship program designed to help people recover from alcohol dependency.

Sobriety

The state of not being under the influence of alcohol or drugs, often used in the context of recovery from addiction.

Q11: Pell Company acquires 80% of Demers Company

Q15: Which of the following statements is true?<br>A)

Q31: Stark Company, a 90% owned subsidiary of

Q32: Bassett Inc. acquired all of the outstanding

Q37: Charleston Inc. acquired 75% of Savannah Manufacturing

Q47: On October 1, 2021, Eagle Company forecasts

Q52: Anderson, Inc. has owned 70% of its

Q71: Natarajan, Inc. had the following operating segments,

Q74: Potter Corp. (a U.S. company in Colorado)

Q86: A company that generates reports by both