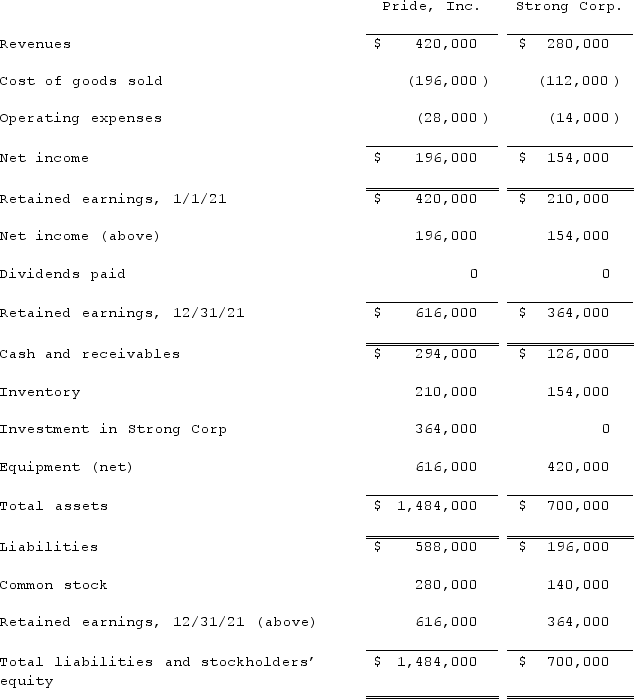

On January 1, 2021, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill, which has not been impaired.As of December 31, 2021, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the consolidated total for equipment (net) at December 31, 2021?

During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the consolidated total for equipment (net) at December 31, 2021?

Definitions:

Sue

Legal action where a party claims to have incurred loss as a result of another party's actions.

Misconduct

Misconduct involves behavior by an individual that is deemed inappropriate or unethical in a professional or personal setting.

Completeness

The quality or state of being complete or whole, with no missing parts.

Witnesses

Individuals who have seen an event, typically an accident or crime, and can provide a firsthand account of what happened.

Q21: Vaughn Inc. acquired all of the outstanding

Q25: Strickland Company sells inventory to its parent,

Q28: Which of the following is false with

Q34: One company acquires another company in a

Q34: Dean Hardware, Inc. is comprised of five

Q40: Beatty, Inc. acquires 100% of the voting

Q82: Clark Stone purchases raw material from its

Q90: Anderson Company, a 90% owned subsidiary of

Q99: When a parent uses the partial equity

Q118: Anderson Company, a 90% owned subsidiary of