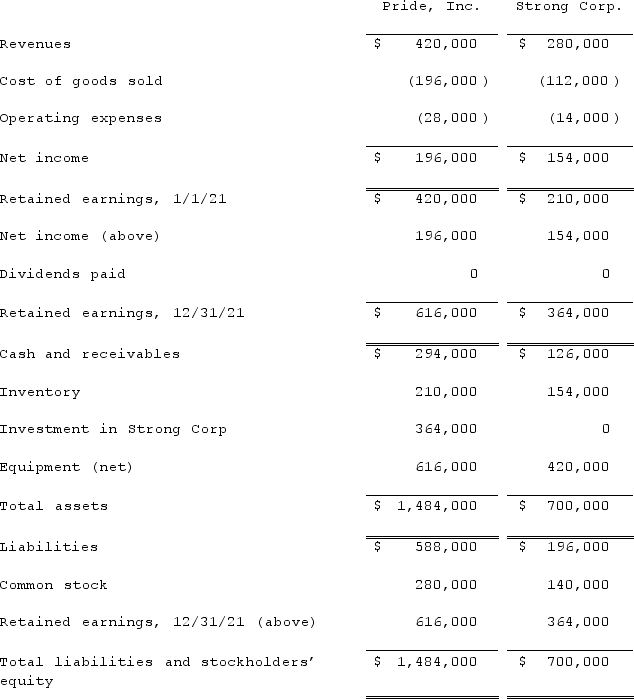

On January 1, 2021, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill, which has not been impaired.As of December 31, 2021, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the consolidated total for inventory at December 31, 2021?

During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the consolidated total for inventory at December 31, 2021?

Definitions:

Implementing Staff

Refers to the personnel responsible for carrying out strategies and plans within an organization.

High-Level Officials

Individuals holding senior or significant positions of authority and responsibility in an organization or government.

Timelines

Visual representations of a sequence of events or activities, typically showing a chronological order.

Diagnosing

The process of identifying and determining the nature of a problem, condition, or disease through evaluation of symptoms and signs.

Q14: Dean Hardware, Inc. is comprised of five

Q25: The financial statements for Campbell, Inc., and

Q33: On January 1, 2021, Musical Corp. sold

Q35: Pell Company acquires 80% of Demers Company

Q36: Jackson Corp. (a U.S.-based company) sold parts

Q46: Stark Company, a 90% owned subsidiary of

Q103: Natarajan, Inc. had the following operating segments,

Q112: Vaughn Inc. acquired all of the outstanding

Q117: Which of the following statements is true

Q119: According to International Financial Reporting Standards (IFRS),