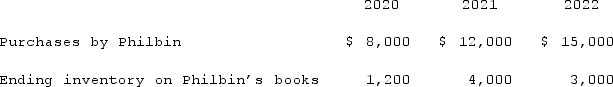

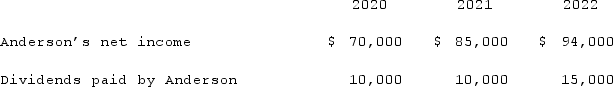

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.  For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2020 consolidation worksheet entry with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2020 intra-entity transfer of merchandise?

For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2020 consolidation worksheet entry with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2020 intra-entity transfer of merchandise?

Definitions:

Treatment Groups

Groups organized within therapeutic contexts aimed at addressing specific issues or conditions through collective support and interventions.

Task Groups

An assembly of individuals brought together to achieve a specific set of objectives, focusing on concrete outcomes.

Group Work Purposes

involves the reasons or objectives behind organizing individuals into groups for completing tasks or projects, which may include enhancing efficiency, fostering creativity, or building team skills.

Social Action

Efforts taken by individuals or groups to bring about social change or improvements in society.

Q8: Pell Company acquires 80% of Demers Company

Q22: To account for a forward contract cash

Q27: McGuire Company acquired 90 percent of Hogan

Q81: Which of the following statements is true

Q81: On January 1, 2020, Archer, Incorporated, paid

Q89: Riley Corp. owned 90% of Brady Inc.,

Q89: What is the difference in consolidated results

Q94: Gaw Produce Company purchased inventory from a

Q102: Pell Company acquires 80% of Demers Company

Q105: On January 1, 2021, Harley Company bought