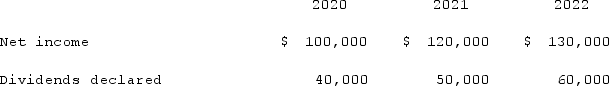

Wilson owned equipment with an estimated life of 10 years when the equipment was acquired for an original cost of $80,000. The equipment had a book value of $50,000 at January 1, 2020. On January 1, 2020, Wilson realized that the useful life of the equipment was longer than originally anticipated, at ten remaining years.On April 1, 2020 Simon Company, a 90% owned subsidiary of Wilson Company, bought the equipment from Wilson for $68,250 and for depreciation purposes used the estimated remaining life as of that date. The following data are available pertaining to Simon's income and dividends declared:  What amount should be recorded on Wilson's books in 2020 as gain on the transfer of equipment, prior to preparing consolidating entries?

What amount should be recorded on Wilson's books in 2020 as gain on the transfer of equipment, prior to preparing consolidating entries?

Definitions:

Intervertebral Foramen

The opening between adjacent vertebrae through which spinal nerves exit the spinal column.

Spinal Nerves

Nerves that originate from the spinal cord and branch out to various parts of the body, carrying messages to and from the brain.

Vertebral Column

A series of vertebrae extending from the skull to the lower back, providing the main support for the upper body and encasing the spinal cord.

Trochlea

Structure shaped like or serving as a pulley or spool.

Q5: Prater Inc. owned 85% of the voting

Q25: The financial statements for Campbell, Inc., and

Q54: The financial statements for Jode Inc. and

Q56: When defining a reportable segment, which of

Q74: Parent Corporation acquired some of its subsidiary's

Q76: Prescott Inc. owned 80% of the voting

Q105: How is a noncontrolling interest in the

Q111: Which of the following is not a

Q116: In measuring the noncontrolling interest immediately following

Q122: Walsh Company sells inventory to its subsidiary,