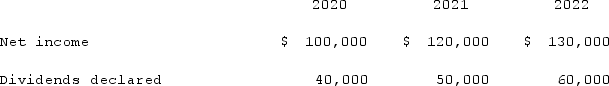

Wilson owned equipment with an estimated life of 10 years when the equipment was acquired for an original cost of $80,000. The equipment had a book value of $50,000 at January 1, 2020. On January 1, 2020, Wilson realized that the useful life of the equipment was longer than originally anticipated, at ten remaining years.On April 1, 2020 Simon Company, a 90% owned subsidiary of Wilson Company, bought the equipment from Wilson for $68,250 and for depreciation purposes used the estimated remaining life as of that date. The following data are available pertaining to Simon's income and dividends declared:  Compute the amortization of gain through a depreciation adjustment for 2020 for consolidation purposes.

Compute the amortization of gain through a depreciation adjustment for 2020 for consolidation purposes.

Definitions:

Attitude Questionnaires

Surveys designed to assess individuals' attitudes, opinions, or beliefs on various topics.

Government Spending

The total amount of money that a government expends on services, infrastructure, public employees, and other items deemed necessary for the nation's welfare and economic health.

Marriage Counselors

Professionals who specialize in providing advice and guidance to couples seeking to improve or save their marriage relationship.

Vent Feelings

The act of expressing emotions, often negative, to relieve stress or tension.

Q9: On January 1, 2021, Nichols Company acquired

Q14: Evanston Co. owned 60% of Montgomery Corp.

Q17: Key Company has had bonds payable of

Q46: Which one of the following accounts would

Q51: How does the treatment of intra-entity gains

Q64: Parker Corp., a U.S. company, had the

Q95: Describe the accounting for direct costs, indirect

Q101: Milton Co. owned all of the voting

Q109: On January 1, 2021, Jackie Corp. purchased

Q124: Anderson Company, a 90% owned subsidiary of