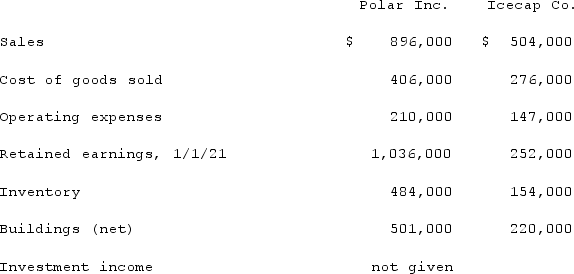

Several years ago, Polar Inc. acquired an 80% interest in Icecap Co. The book values of Icecap's asset and liability accounts at that time were considered to be equal to their fair values. Polar's acquisition value corresponded to the underlying book value of Icecap so that no allocations or goodwill resulted from the transfer.The following selected account balances were from the individual financial records of these two companies as of December 31, 2021:  Assume that Icecap sold inventory to Polar at a markup equal to 25% of cost. Intra-entity transfers were $70,000 in 2020 and $112,000 in 2021. Of this inventory, $29,000 of the 2020 transfers were retained and then sold by Polar in 2021, whereas $49,000 of the 2021 transfers were held until 2022.Required:For the consolidated financial statements for 2021, determine the balances that would appear for the following accounts: (i) Cost of Goods Sold; (ii) Inventory; and (iii) Net income attributable to the noncontrolling interest.

Assume that Icecap sold inventory to Polar at a markup equal to 25% of cost. Intra-entity transfers were $70,000 in 2020 and $112,000 in 2021. Of this inventory, $29,000 of the 2020 transfers were retained and then sold by Polar in 2021, whereas $49,000 of the 2021 transfers were held until 2022.Required:For the consolidated financial statements for 2021, determine the balances that would appear for the following accounts: (i) Cost of Goods Sold; (ii) Inventory; and (iii) Net income attributable to the noncontrolling interest.

Definitions:

Advertising Expenditures

Money spent on advertising products or services to attract potential customers.

Advertising Elasticity of Demand

The responsiveness of the quantity demanded of a product to a change in the amount spent on advertising for that product.

Marginal Costs

The additional cost incurred when producing one more unit of a product or service.

Advertising Elasticity of Demand

A measure of how responsive the quantity demanded of a good is to a change in the amount of advertising for that good.

Q9: Lewis Corp. acquired all of the voting

Q22: Jaynes Inc. acquired all of Aaron Co.'s

Q26: On January 1, 2021, Chester Inc. acquired

Q36: In a situation where the investor exercises

Q42: Jackson Company acquires 100% of the stock

Q45: What is the basic objective of all

Q46: The following information for Urbanski Corporation relates

Q52: Following are selected accounts for Green Corporation

Q70: Chase Incorporated sold $260,000 of its inventory

Q95: Describe the accounting for direct costs, indirect