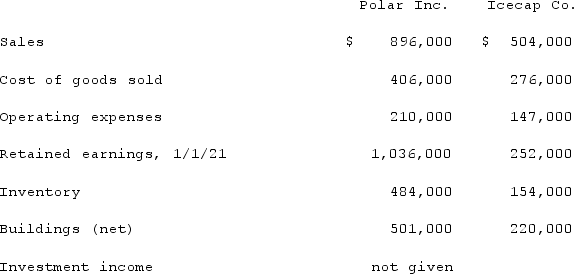

Several years ago, Polar Inc. acquired an 80% interest in Icecap Co. The book values of Icecap's asset and liability accounts at that time were considered to be equal to their fair values. Polar's acquisition value corresponded to the underlying book value of Icecap so that no allocations or goodwill resulted from the transfer.The following selected account balances were from the individual financial records of these two companies as of December 31, 2021:  Polar sold a building to Icecap on January 1, 2020 for $112,000, although the book value of this asset was only $70,000 on that date. The building had a five-year remaining useful life and was to be depreciated using the straight-line method with no salvage value.Required:For the consolidated financial statements for 2021, determine the balances that would appear for the following accounts: (i) Buildings (net); (ii) Operating expenses; and (iii) Net income attributable to the noncontrolling interest.

Polar sold a building to Icecap on January 1, 2020 for $112,000, although the book value of this asset was only $70,000 on that date. The building had a five-year remaining useful life and was to be depreciated using the straight-line method with no salvage value.Required:For the consolidated financial statements for 2021, determine the balances that would appear for the following accounts: (i) Buildings (net); (ii) Operating expenses; and (iii) Net income attributable to the noncontrolling interest.

Definitions:

Transnational Hybrid

A business model combing elements from multiple cultural or legal frameworks, operating across national borders.

Private Sector

The part of the economy that is run by individuals and companies for profit rather than by the state.

Civil Society

The sphere of social life that is open to public participation and forms independently of the state, including organizations, movements, and clubs.

Services

Intangible products provided to consumers or businesses, involving human or mechanical effort.

Q1: Carnes Co. decided to use the partial

Q4: Panton, Inc. acquired 18,000 shares of Glotfelty

Q19: Walsh Company sells inventory to its subsidiary,

Q27: Jones, Incorporated acquires 15% of Anderson Corporation

Q32: On January 1, 2020, Smeder Company, an

Q45: On January 1, 2021, Musical Corp. sold

Q47: Under what conditions must a deferred income

Q73: The financial statements for Campbell, Inc., and

Q82: Anderson, Inc. acquires all of the voting

Q90: If a company does not include a