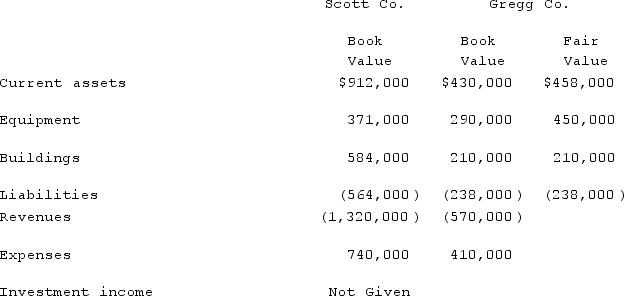

Scott Co. acquired 70% of Gregg Co. for $525,000 on December 31, 2019 when Gregg's book value was $580,000. The Gregg stock was not actively traded. On the date of acquisition, Gregg had equipment (with a ten-year life) that was undervalued in the financial records by $170,000. One year later, the two companies provided the selected amounts shown below. Additionally, no dividends have been paid.  What amount of consolidated net income for 2020 is attributable to Scott's controlling interest?

What amount of consolidated net income for 2020 is attributable to Scott's controlling interest?

Definitions:

Unlicensed Assistive Personnel

Individuals who are trained to assist in patient care activities under the supervision of a licensed healthcare professional but are not licensed themselves.

Motor Vehicle Accident

An unexpected event involving a vehicle on a road or highway that results in damage or injury.

Interactive Processes

The dynamic activities and exchanges between people, often involving communication and feedback mechanisms.

House Rules

Regulations or guidelines established within a household, institution, or organization to ensure orderly and harmonious operation.

Q4: Dutch Co. has loaned $90,000 to its

Q10: Paris, Inc. owns 80% of the voting

Q23: Cayman Inc. bought 30% of Maya Company

Q40: Steven Company owns 40% of the outstanding

Q42: Gamma Co. owns 80% of Delta Corp.,

Q64: Presented below are the financial balances for

Q96: Dodd Co. acquired 75% of the common

Q106: Faru Co. identified five industry segments: (1)

Q123: Kenzie Co. acquired 70% of McCready Co.

Q125: Tate, Inc. owns 80% of Jeffrey, Inc.