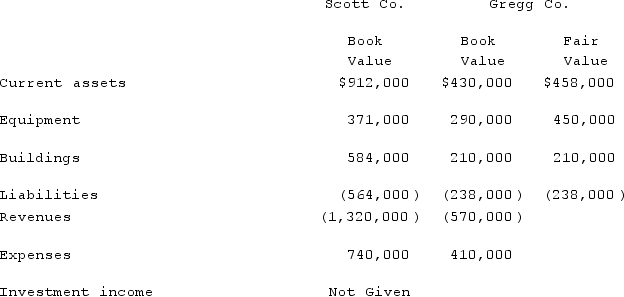

Scott Co. acquired 70% of Gregg Co. for $525,000 on December 31, 2019 when Gregg's book value was $580,000. The Gregg stock was not actively traded. On the date of acquisition, Gregg had equipment (with a ten-year life) that was undervalued in the financial records by $170,000. One year later, the two companies provided the selected amounts shown below. Additionally, no dividends have been paid.  What is the noncontrolling interest's share of the subsidiary's net income for the year ended December 31, 2020 and what is the ending balance of the noncontrolling interest in the subsidiary at December 31, 2020?

What is the noncontrolling interest's share of the subsidiary's net income for the year ended December 31, 2020 and what is the ending balance of the noncontrolling interest in the subsidiary at December 31, 2020?

Definitions:

Weak Economy

A state where a country's overall economic performance is poor, characterized by low growth, high unemployment, and declining business activities.

Job Depth

The degree of control employees have over their tasks and procedures at work.

Assembly Line

A manufacturing process that breaks down the production into sequential steps carried out by different workers, significantly increasing efficiency.

Gain-Sharing Plan

A type of incentive plan that gives employees a share of the company's saved costs or increased profits, typically resulting from their collective efforts to improve performance.

Q14: Dean Hardware, Inc. is comprised of five

Q41: What is the appropriate treatment in an

Q55: Provo, Inc. has an estimated annual tax

Q67: Wilkins Inc. acquired 100% of the voting

Q89: Hudson Corp. owned a 85% interest in

Q89: A business combination results in $90,000 of

Q96: Florrick Co. owns 85% of Bishop Inc.

Q97: On January 1, 2021, Harrison Corporation spent

Q121: Pell Company acquires 80% of Demers Company

Q126: Tate, Inc. owns 80% of Jeffrey, Inc.