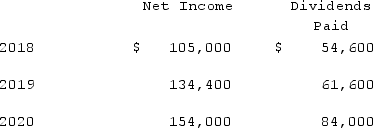

On January 1, 2018, Vacker Co. acquired 70% of Carper Inc. by paying $650,000. This included a $20,000 control premium. Carper reported common stock on that date of $420,000 with retained earnings of $252,000. A building was undervalued in the company's financial records by $28,000. This building had a ten-year remaining life. Copyrights of $80,000 were to be recognized and amortized over 20 years.Carper earned income and paid cash dividends as follows:  On December 31, 2020, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.Required:If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2020?

On December 31, 2020, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.Required:If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2020?

Definitions:

Employees

Individuals hired by a business or organization to perform specific duties in exchange for compensation.

Community

A group of people living in the same place or having a particular characteristic in common.

Follower-Centered

An approach in leadership that focuses on the needs, development, and well-being of the followers, rather than on the leader themselves.

Motivational Process

The internal mechanisms and external stimuli that propel individuals to act or perform in certain ways.

Q19: Flynn acquires 100 percent of the outstanding

Q32: Beagle Co. owned 80% of Maroon Corp.

Q34: On January 3, 2021, Roberts Company purchased

Q55: Where do dividends paid by a subsidiary

Q63: McGuire Company acquired 90 percent of Hogan

Q88: Tower Company owns 85% of Hill Company.

Q103: Flynn acquires 100 percent of the outstanding

Q109: Blanton Corporation is comprised of five operating

Q119: Alpha Corporation owns 100% of Beta Company,

Q120: Beagle Co. owned 80% of Maroon Corp.