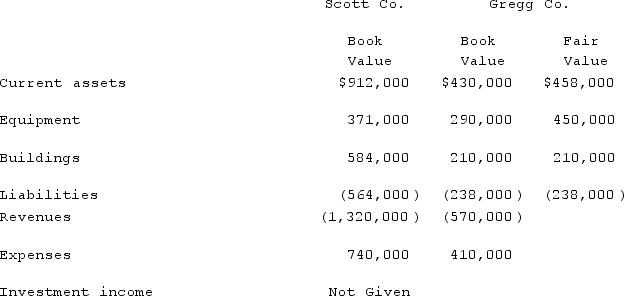

Scott Co. acquired 70% of Gregg Co. for $525,000 on December 31, 2019 when Gregg's book value was $580,000. The Gregg stock was not actively traded. On the date of acquisition, Gregg had equipment (with a ten-year life) that was undervalued in the financial records by $170,000. One year later, the two companies provided the selected amounts shown below. Additionally, no dividends have been paid.  What amount of consolidated net income for 2020 is attributable to Scott's controlling interest?

What amount of consolidated net income for 2020 is attributable to Scott's controlling interest?

Definitions:

Questionnaire Data

Information collected through structured question forms designed to gather specific information from respondents.

Panel

A group of selected individuals who are surveyed or observed over a period to track changes in their opinions, behavior, or health.

Focus Consultation

Targeted advisory services aimed at addressing specific challenges or objectives, often involving in-depth discussions and expert advice.

Face-To-Face Exchange

Direct interaction between buyers and sellers without any intermediaries, allowing personal negotiation and transactions.

Q7: Chase Company owns 80% of Lawrence Company

Q35: For an acquisition when the subsidiary retains

Q40: If a subsidiary re-acquires its outstanding shares

Q53: White Company owns 60% of Cody Company.

Q55: Provo, Inc. has an estimated annual tax

Q60: The newly opened Stone Restaurant was unable

Q63: Which of the following results in a

Q67: Wilkins Inc. acquired 100% of the voting

Q81: On January 1, 2020, Archer, Incorporated, paid

Q98: Prater Inc. owned 85% of the voting