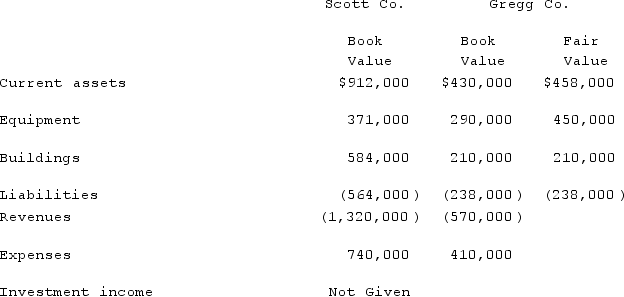

Scott Co. acquired 70% of Gregg Co. for $525,000 on December 31, 2019 when Gregg's book value was $580,000. The Gregg stock was not actively traded. On the date of acquisition, Gregg had equipment (with a ten-year life) that was undervalued in the financial records by $170,000. One year later, the two companies provided the selected amounts shown below. Additionally, no dividends have been paid.  What is the consolidated balance of the Equipment account at December 31, 2020?

What is the consolidated balance of the Equipment account at December 31, 2020?

Definitions:

Balance Sheet

A financial statement that shows a company's financial position at a specific point in time, detailing assets, liabilities, and shareholders' equity.

Cost Method

An accounting approach used for investments, where the investment is recorded at its original purchase cost without considering changes in its market value.

Equity Method

An accounting technique used to record investments in other companies, where the investment is reported as an asset and the investor's share of the investee's income is reported in the income statement.

Gross Profit

The financial metric resulting from subtracting the cost of goods sold from sales revenue, measuring the efficiency of production.

Q6: Flynn acquires 100 percent of the outstanding

Q9: Thompson Corp. was engaged solely in manufacturing

Q14: Dean Hardware, Inc. is comprised of five

Q24: Thomas Inc. had the following stockholders' equity

Q46: Daniels Inc. acquired 85% of the outstanding

Q56: Jones, Incorporated acquires 15% of Anderson Corporation

Q56: Kaye Company acquired 100% of Fiore Company

Q60: On January 1, 2021, Bangle Company purchased

Q72: How does the use of the equity

Q90: Which of the following statements is true